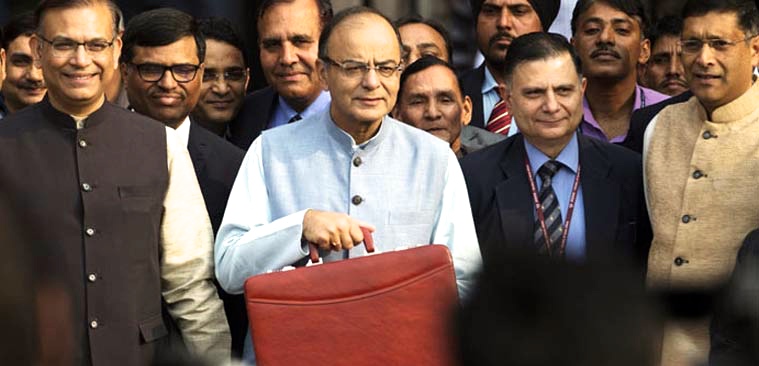

Last week was Budget Day in India: Finance Minister Arun Jaitley presented the 2018/2019 budget. How will the announced policy affect your business and what opportunities will it bring?

Photo: Financial Express

1. Billion-dollar investments

In view of India's national elections in 2019, the Modi government is focusing fully on domestic challenges: combating poverty, professionalising agriculture, investing in healthcare, electricity and (digital) infrastructure are the main focal points. Entrepreneurship is also being encouraged with a lower corporate tax rate for SMEs.

Agriculture

The Indian government will invest heavily in essential infrastructure, especially in rural areas, in the coming term. The budget of the Ministry of Agriculture will increase by 15% to about 7 billion Euros. India is bursting with small, marginalised farmers and the central government wants to link them to markets so they can get adequate remuneration for their production. The government subsidises farmers' livelihoods and invests billions in building better infrastructure in rural areas. Think of more efficient agricultural logistics, cold chain, irrigation and aquaculture. Subsidies are also provided for harvesting machines and for machines to process post-harvest waste intelligently. At the moment, a lot of post-harvest waste is set on fire, which causes enormous air pollution in the capital city of Delhi, among other places. There are excellent opportunities in agriculture for Dutch companies, which are also supported by the Dutch government with a DHI subsidy.

Electricity

India is a net importer of electricity and regularly experiences blackouts. Especially in rural areas, the electricity supply is very poor: power cuts are considered normal in large parts of India. EUR 2 billion is being set aside to provide electricity to 40 million households in rural areas. The money will be invested in both conventional and sustainable power plants: coal, natural gas, LNG, combined heat and power, hydropower, wind and solar energy projects. Here too, there are obviously opportunities for Dutch companies with smart technology in the field of (renewable) energy.

Healthcare

India does not score well in the Global Burden of Disease (GBD) survey by the authoritative medical journal The Lancet. The current government wants to change that and is launching the National Health Protection Scheme this year to make Indian healthcare affordable and accessible to the masses. Modicare, as the programme is already called, will be the largest national health programme in the world. In addition, EUR 150 million has been earmarked for clinics, medicines and medical equipment in the coming period.

Less corporate tax

To reduce the tax burden on Indian SMEs and create large-scale employment opportunities, the low 25% rate is being extended to companies that reported a turnover of up to Rs. 250 crore (30 million Euros) in the financial year 2016-17. As a result, roughly 99% of Indian companies will be covered by this rate. Foreign companies with a presence in India also benefit from this. After all, the measure makes it more attractive for foreign investors to manufacture in India. The Make in India campaign is one of the pillars of the Modi government's policy.

Robotics, AI and IoT

The National Institute for Transforming India (NITI) of which Prime Minister Modi himself is the chairman has announced in this budget to set up a nationwide Artificial Intelligence programme and Centres of Excellence in the field of Robotics, Artificial Intelligence and Internet of Things (IOT).

Cryptocurrency and blockchain

The government does not regard cryptocurrencies as legal tender and will take measures to eliminate their use in funding illegal activities or as part of the payment system. The use of blockchain technology, on the other hand, is recognised. Blockchain allows organisations to record and authenticate transactions without the need for intermediaries. The government will therefore proactively explore the use of blockchain technology to promote the digital economy.

2. Digitisation

The government is investing in modern technology to make communication between government and citizens more efficient and transparent. Various online tools are also being used to improve the business climate.

E-assessment

In order to reduce bureaucracy between the taxpayer and the tax authorities, all assessments (except in exceptional cases) are carried out through this electronic medium. The anonymous e-assessment procedure is expected to reduce costs and increase taxpayers' confidence in the government.

Customs Automated System

In order to ease customs procedures, the government is introducing the so-called Customs Automated System. This system aims to simplify the import and export of goods. Transparent documentation, rapid processing and lower costs for customs clearance of goods should benefit trade.

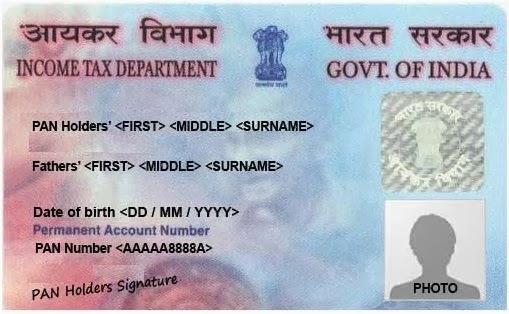

Permanent Account Number (PAN)

The government is making the PAN card mandatory for any entity entering into a financial transaction of Rs 2.5 lakh or more with effect from April 1, 2018. The 10-digit permanent account number (PAN) will be used as a unique identity number for non-individuals. To link the financial transactions to natural persons, it is proposed that the director, director, partner, trustee, CEO, founder or any person authorised to act on behalf of an entity should also have a PAN.

3. Higher taxes

Of course, all these investments by the Indian government have to be paid for from somewhere. Indeed, from taxes. Below is an overview of the proposed tax increases by the Indian government.

Import levies

Import duties are being raised significantly in more than 10 sectors to discourage imports, mainly from China and other Asian countries. The increased import duties target products such as commercial vehicles, cars, mobile phones, watches, crude and edible oils, fruit juices, perfumes and toiletries, footwear and fake jewellery, among others. With these too, the government is trying to make Make in India more attractive and support domestic manufacturers.

| Category | Budget 2017/18 | Budget 2018/19 |

| Mobile phones | 15% | 20% |

| Import duty on Completely Knocked Down (CKD, i.e. in parts) passenger cars and commercial vehicles | 10% | 15% |

| Import duty on Completely Built Units (CBU) passenger cars and commercial vehicles | 20% | 25% |

| Parts such as engines, gearboxes, brakes etc. | 7,5% | 15% |

| Lithium-ion batteries for use in electric and hybrid vehicles | 10% | 20% |

| Fruit and vegetable juices | 30% | 50% |

| Watches (including smart watches and wearables), sunglasses and shoes | 10% | 20% |

| Diamonds, jewellery and precious stones | 2,5% | 5% |

However, the impact of these changes will not be dramatic. For example, the increase of import duties on imported mobile phones to 20% will result in an estimated 4% increase in the price of Apple and Google mobile phones. Incidentally, about 80% of mobile phones sold in India are already made in India, according to the Indian Cellular Association.

80% of mobile phones sold in India are madein India

The impact of higher import duty on luxury consumer products will have relatively little effect on demand. India's elite is willing to fork out a little more for watches, jewellery and gadgets. Of course, the higher import duty will stimulate domestic production of these goods and curb the flow of cheap goods from China to some extent. This is important for India given its huge trade deficit with that country.

The import costs will further increase by 1 to 2% on average as a result of the social welfare tax. This tax will be used for various government Social Welfare Schemes aimed at improving education, healthcare and social security.

Wealth tax

Investors will pay tax on the sale of their shares or mutual funds held for more than a year. Investors will pay 10% on profits above Rs. 100,000 (EUR 1,200). Until now, LTCG(Long Term Capital Gains) was exempt from tax. Long-term capital gains on listed shares made ot 31 January 2018 are exempt. This also applies to foreign institutional investors.

Approach of Amazon, Google, AirBnB and Netflix

India wants to tax companies that have a large number of users but no significant physical presence in India. With this, the Indian government is taking the lead in implementing the OECD and G20 discussion on Base Erosion and Profit Shifting (BEPS). The proposed tax will not only affect large companies such as Google, Facebook, AirBnB or Netflix, but also much smaller technology or internet companies with operations in India. The government wants to amend the Income Tax Act to stipulate that"significant economic presence" in India also constitutes a"business connection". All cross-border transactions between group companies must be valued atarm'slength, or as if the transaction were with an unrelated company, to ensure that multinationals do not use transfer prices to move their profits to low-tax countries.