E-commerce is booming in India and there are great opportunities for international companies in this market. However, in recent years, the Indian government has imposed various restrictions on foreign companies wishing to sell online in India. What do you need to comply with if you want to profit from one of the world's largest online markets? How do you go about it?

Indian e-commerce market grows explosively

With more than 759 million Internet users, India is the world's second-largest online market. It is estimated that there will be more than 900 million Internet users in the country by 2025. During the pandemic, Indians switched en masse to e-commerce platforms for their daily purchases. This further boosted the country's e-commerce market.

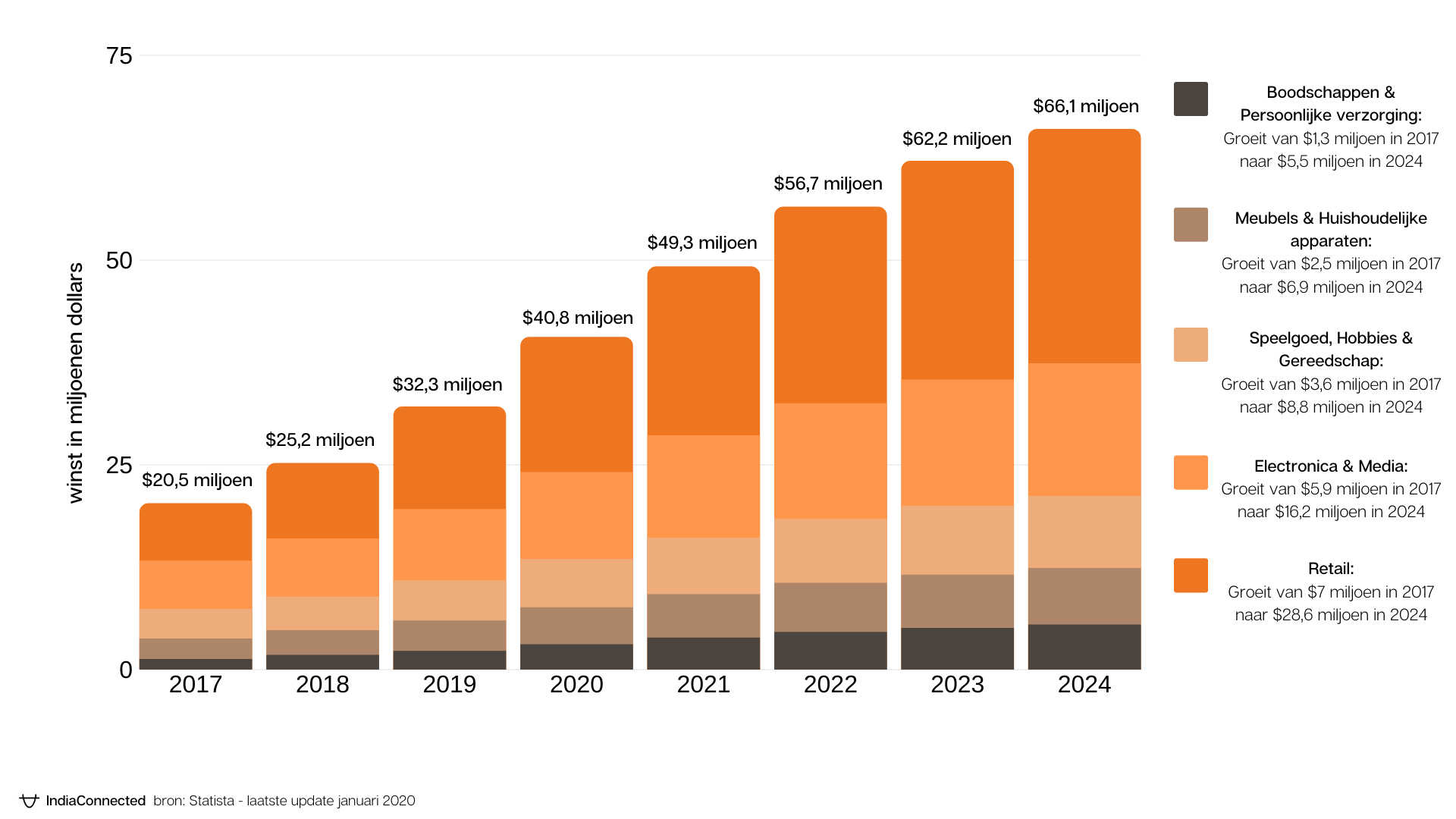

Consultancy Bain & Company expects the market size of the Indian e-commerce market to increase from about $30 billion in 2020 to $350 billion in 2030.

Not for nothing are retail giants such as Amazon and Walmart betting heavily on India. Jeff Bezos recently promised to invest another billion dollars in India, and Walmart further expanded its majority 60% stake in Indian e-commerce market leader Flipkart, with a $1.2 billion investment.

To curb the influence of these American mega-corporations and provide as much transparency to consumers as possible, the Indian government has introduced special regulations that you, as a foreign investor, must consider.

The rules for foreign companies in the Indian e-commerce market

Since 2015, 100% Foreign Direct Investment has been allowed in the Indian e-commerce market, but that does not mean that every foreign company can open its own webshop and start selling to Indian consumers. The Indian government applies two different models within the e-commerce market with specific rules and restrictions for foreign investors:

The inventory model

In the inventory model, which we know from companies like Amazon or Bol.com, goods and services are owned by the e-commerce company and then sold directly to the customer. The e-commerce company thus owns the inventory and the platform on which the goods are sold.

Current Indian regulations do not allow Foreign Direct Investment in the inventory model. This means that a foreign company cannot run a web shop in India on which it sells goods and services from its own inventory, because the regulations do not allow a foreign company to own 100% of the sales platform and of this inventory.

However, there are exceptions to this rule. A foreign entity may hold up to 49% of the shares of an Indian e-commerce platform with an inventory model if:

Made in India productsare sold on the platform;

The founder is an Indian national;

The company is run by Indian management;

The company raises funds domestically, allowing large Indian companies to reinvest in new start-ups in the sector.

The marketplace model

In the marketplace model, the e-commerce entity only owns the online platform and is therefore the facilitator between sellers and buyers. In addition, the e-commerce company may provide support services to its sellers such as logistics, warehousing, call centre and payment collection.

In the marketplace model, 100% Foreign Direct Investment is allowed and foreign companies are thus allowed to fully own an e-commerce platform, as long as they do not own the inventory. But more rules apply to foreign-owned e-commerce platforms:

E-commerce platforms are not allowed to sell products from companies in which they have shares;

The e-commerce entity may not exercise any influence or ownership over the goods/services sold on the platform. For example, an e-commerce platform cannot take the initiative to offer products at deep discounts; the company is then automatically seen as an e-commerce entity with the inventory model, with all its consequences.

A company selling through an Indian e-commerce platform may not contribute more than 25% of the platform's total sales.

Online exclusive brands are not allowed. It is prohibited for an e-commerce entity to make exclusive arrangements with a seller to sell its products exclusively on one platform.

The seller's name & contact details must be on the website.

After-sales activities are the sole responsibility of the seller. The entity operating the e-commerce platform may not offer this service.

Consumer Protection Act 2019

In late July 2020, the Indian government presented a new law with obligations for e-commerce retailers. The Consumer Protection Act 2019 should provide consumers with more transparency into the company and its products so they can make informed decisions.

E-retailers will therefore be required to include details about returns, refunds, exchanges, warranty, delivery and shipping, payment methods and complaint mechanisms, and the "country of origin" on their platform starting in 2020. The indication of the country of origin must also appear on the products themselves.

International companies offering their goods and services in the marketplace of an Indian e-commerce entity must provide the above information to that entity.

E-commerce platforms are required, starting in 2020, to provide consumers with as much data as possible about the sellers on their platform. Such as the company's name, address, customer service number and any reviews or other feedback about the seller or products.

Finally, the product must state the "total price" along with any hidden additional costs such as shipping costs, and platforms must not "manipulate" the price of the goods and services offered to make unreasonable profits.

The e-commerce rules are enforced by the Central Consumer Protection Authority (CCPA) in India, and violations of the new act carry hefty fines. Therefore, make sure your entity in India is always compliant with the latest regulations.

Not sure if you are fully compliant? Our experts will run a check for you and give you clear next steps so you are back up to date.

Praveen Singal

Financial advisor - IndiaConnected

This article was written in collaboration with IndiaConnected's financial advisor, Praveen Singal.

Singal has over 25 years of experience in establishing successful business strategies for European companies looking to start up in India, corporate financial analysis and compliance.

He is also a qualified Chartered Accountant with a specialization in Indian taxation.