The Dutch translation of due diligence is 'with due care'. Unlike in the Netherlands, as a buyer you have no legal obligation to investigate in India. Nevertheless, it is crucial to extensively screen the background of the Indian party before engaging with your business partner. This is how you conduct thorough due diligence of an Indian company (Private Limited).

Due diligence in India

Due diligence is typically performed prior to the purchase of a business or investment in a business by the acquirer or investor. It is sometimes referred to as an audit, but a proper due diligence process goes beyond simply checking the financial statements.

Due diligence helps make the right decision and mitigate the risks associated with the business transaction. Both parties usually enter into a confidentiality agreement before a business due diligence is initiated, as sensitive financial, operational, legal and regulatory information is revealed during the due diligence process.

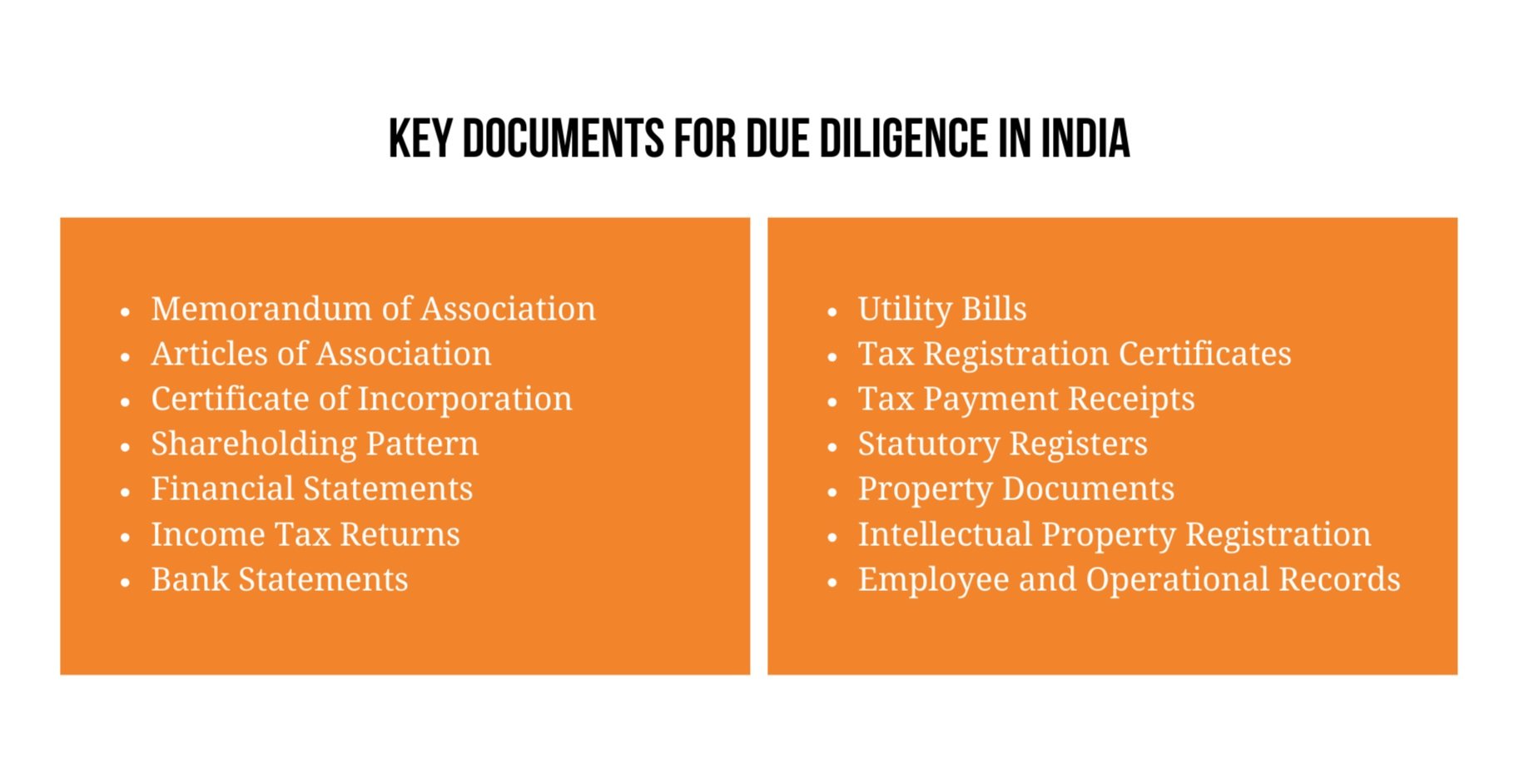

It is the responsibility of the seller of the company or the shareholder to provide the documents and information necessary to conduct due diligence. In India, it is no different. Typically, the documents listed below are required for conducting due diligence on a private limited. All these documents should be thoroughly reviewed by an expert in India to make an informed decision:

Review of MCA documents.

Much of a company's due diligence can be done with the help of the Ministry of Corporate Affairs (MCA). The MCA regulates business affairs in India through the Companies Act, 1956, 2013 and other related laws and regulations. All companies in India must file their financials and shareholder data with the MCA. These details (master data) of each company can therefore be accessed through the website the MCA.

The documents, before being filed with the MCA, are approved by the Registrar of Companies (ROC). For a fee, all documents filed with the ROC are made available. The information provided by the MCA is available for one day and is provided under the Right to Information Act. The information collected in this step includes the following, among others:

1. Financial statements;

2. Annual reports;

3. Legal proceedings against the director or company;

4. Lien on assets;

5. Any problem with non-compliance law/regulations.

These are mainly documents filed after September 16, 2006. Prior to this date, documents were submitted to the ROC in the physical form. These documents were kept in the respective ROC and are not accessible online. To inspect these documents, one must visit the respective ROC.

Reputation

In addition to legal information, it is wise to examine the company's reputation in the marketplace. How is the company generally known to customers, suppliers, employees and other stakeholders? Does the company have a good and reliable name in the market? Does the company have a good payment reputation? Has the company entered into other strategic collaborations before and how did they work out?

Apart from Indian companies' own websites (usually in English), the professional federation of the sector in which the company operates can be an interesting source of information for this purpose. There are also a number of important national business organizations in India, many of which have regional branches. The main ones are:

Confederation of Indian Industry (CII): www.cii.in

Federation of Indian Chambers of Commerce and Industry (FICCI): www.ficci.com

The Associated Chambers of Commerce of India (ASSOCHAM): www.assocham.org

Chamber of Commerce and Industry (PHD): www.phdcci.in

Finally, on the Credit Information Bureau (India) Limited (CIBIL) website, you can check the credit history of an individual, company or partnership. Any disputes/cases filed against the company can be checked and also whether they have ever been declared a wilful defaulter in the past.

Thinking about a merger, M&A or setting up a Joint Venture?

Partnering with an Indian company can be a great way to enter the Indian market. With a good Indian partner, you immediately have an extensive network, knowledge of the market and share the business risk. But there are legal rules and conditions attached to setting up such a partnership.

IndiaConnected helps companies realize mergers, M&A and joint ventures as a trusted advisor and sparring partner. We support parties throughout the entire process: from partner search to due diligence and negotiations.

Are you interested in finding a suitable partner in India? Or would you like to know more about what is required for an acquisition or joint venture?