Acquiring a company in India is not without risks, noted Johan de Boer, managing director of KROV. The Dutch manufacturer of train, office and store fittings decided to abandon the acquisition of a manufacturing partner in the Indian city of Bangalore after extensive due diligence.

Have thorough research done before you engage with an Indian partner

"It's not down to the products the Indian company makes," De Boer reflects. "The quality is fine. We offer their products in Europe and they themselves sell directly to customers in America." After the owner indicated a desire to sell the company, De Boer visited the factory in August for an initial thorough inspection. Then began the due diligence process, conducted by an Indian accountant and a local lawyer. In December, they delivered their report with the advice: don't do it.

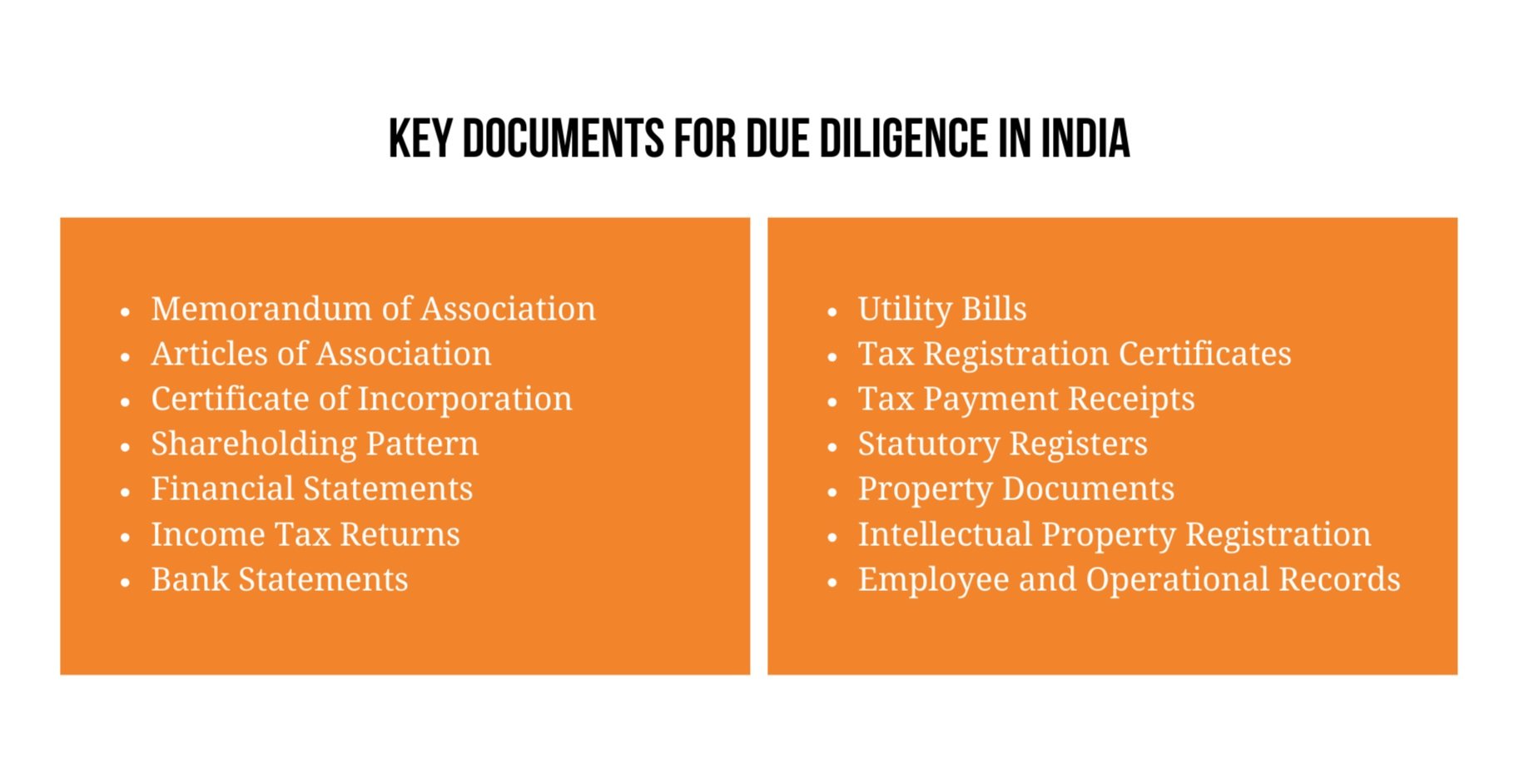

Both financially and legally, the producer was found not to have its affairs in order. Those figures did not match the reporting. That was surmountable, according to De Boer, but the findings of the lawyer were less innocent. The company turned out to be incorrectly registered, irregularities regarding personnel contracts came to light, and the administration and payment of social security contributions were not in order. "That not only carries hefty fines, as an owner you can even end up in jail for that," he said.

Work with local advisors

For De Boer, this experience reaffirms the importance of recruiting good local consultants in India. "If we had conducted this process independently, we might not have been able to bring this to the surface. Then you are suddenly liable for a company in which things are not properly arranged. Afterwards, you can't fix that. The consequences, financial or worse, are then yours." To put it mildly, the current owner was not happy that De Boer renounced the deal. "He still tried to tone down the irregularities, but I didn't hire advisors for nothing. It would be stupid to go against their advice."

Still, De Boer remains interested in the Indian producer. "I know that this factory in India delivers quality and the relatively low production costs are of course attractive. That is why we have now discussed an alternative route. If the Indian owner liquidates the company, we would then like to take over the factory premises, machinery and some of the employees. That would remove the legal risks for us. The current owner is keen on this. We have agreed to discuss this further in the coming year."

Producing in India has interesting advantages

De Boer has another reason for wanting to manufacture in India. "KROV has a good reputation worldwide as a supplier of train equipment, such as tables, chairs and backrests. India has the ambition to build a nationwide network of high-speed trains and we are already in talks about this through main manufacturer Kawasaki. Our position is stronger when we have a production facility in India, because the Indian government would like to create as many jobs in India as possible. So an Indian plant would also be interesting with a view to sales there."

Do you want to enter the Indian market, but are unsure what is the best first step for your business? Or are you looking for a local party to conduct market research or due diligence for you?