If you are a company operating in multiple countries, you must comply with the legal rules on Transfer Pricing established by the Organization for Economic Cooperation and Development (OECD) in all these countries. This is an attempt to prevent companies from dropping their profits through ingenious constructions in countries with very low tax rates, thus avoiding tax. In India too, these intercompany transactions are closely monitored for this reason. It is therefore essential for a European company with cross-border intercompany transactions to be well aware of and comply with the Transfer Pricing rules in India.

What is Transfer Pricing?

Transfer Pricing (TP) are internal transfer prices for the supply of goods, services or intellectual property rights within affiliated companies. With a transfer pricing policy, it becomes clear where the international company earns its profits and in which countries these profits must be taxed. By means of a transfer pricing policy, it is also clear how the mutual prices of a group of companies are established.

Transactions that take place between related parties should, according to the OECD guidelines, follow the so-called arm's-length principle. This means that the transfer price between related parties must be equal to the price charged to each other by independent parties in uncontrolled circumstances. This concerns transactions such as:

the purchase, sale or lease of tangible or intangible property,

service,

borrowing or lending money,

any transaction that affects profits, revenues, losses or assets

Mutual agreement between AEs for sharing costs and expenses.

Transfer Pricing in India

Sections 92 to 92F of the Indian Income Tax Act, 1961 provide guidelines for calculating TP and the procedures to be followed for transactions entered into between two or more companies belonging to the same group. The Indian TP legislation is largely influenced by the OECD TP guidelines, but they are adapted to specifically meet the needs of the Indian tax system.

Scope of application of Transfer Pricing Regulations

Transfer Pricing Regulations (TPR) apply to all companies entering into an International Transaction or cross-border transactions with an Associated Enterprise (AE). The aim is to arrive at an Arm's Length Price (ALP). This is a transfer price equal to the price charged by independent parties to each other in uncontrolled circumstances. In India, this would amount to Market Retail Price (MRP). MRP is the maximum price calculated by the manufacturer that may be charged for a product sold in India. However, retailers may choose to sell products for less than the MRP.

Arm's Length Price (ALP)

The Arm's Length Price (ALP) or the transfer price that parties would have charged if the transaction had been between two unknown parties must be determined in India through one of the following methods laid down in law:

Comparable uncontrolled price (CUP) method;

Resale price method (RPM);

Cost plus method (CPM);

Profit split method (PSM);

Transactional net margin method (TNMM);

Such other methods.

In this regard, the Central Board of Direct Taxes has stated that 'such other methods' can be any method that takes into account the price charged for the same or similar transactions, with or between non-associated companies, in similar circumstances and having regard to all relevant facts.

None of the methods is considered a priority by the Indian tax authorities. The most appropriate method for the transaction is determined on the basis of the nature and class of the transaction or the persons and functions associated with it.

Associated Enterprise (AE)

An enterprise is an Associated Enterprise (AE) if it participates in the management of and/or has control over another enterprise. The participation can be direct or indirect, or through one or more intermediaries. Control is defined more broadly than having shares, voting rights or the power to appoint the management of a company. Having debts and control over different parts of the business, such as raw materials, sales and intangible assets is also included in the legal definition.

Transfer Pricing Documentation

In India, as in Europe, there are documentation requirements for transfer pricing. It is based on OECD guidelines and requires companies to prepare three documents:

Master file: This is required to maintain information about the business, including information on financial and non-financial activities.

Local file: This should contain all relevant information on intercompany transactions of the company, in each individual country.

Country by Country Report (CbCR): CbCR should contain information on income, taxes paid and measures for economic activities in countries where the company operates.

Furthermore, it is also mandatory to obtain an independent audit opinion for all international transactions between AEs. Information on the selection of the most appropriate method for determining ALP must also be maintained. Concerns below the threshold of INR 10 million with and international transactions are not required to keep such documentation. But even in these cases, it is imperative that documentation can be provided to support the arm's-length price selected for the international transactions.

Burden of proof

The responsibility for determining the correct ALP lies with the taxpayer, i.e. the company. The ALP must be in accordance with the applicable Transfer Pricing Laws and supported by the prescribed documentation. If the tax official is of the opinion that:

the price charged in the international transaction has not been determined in accordance with prescribed ALP methods,

information and documents relating to the international transaction have not been stored and maintained in accordance with the TPR,

the information or data used for calculating the ALP is not correct or reliable,

the company has failed to provide information or documents that it should have submitted

- It may reject the company's ALP and hand the case over to a Transfer Pricing Officer (TPO), who will start an investigation. If this reveals that the company has failed to declare certain income, the taxpayer's reported income or the ALP may be adjusted to an amount that is in line with the TPR. In many cases, a fine is also imposed.

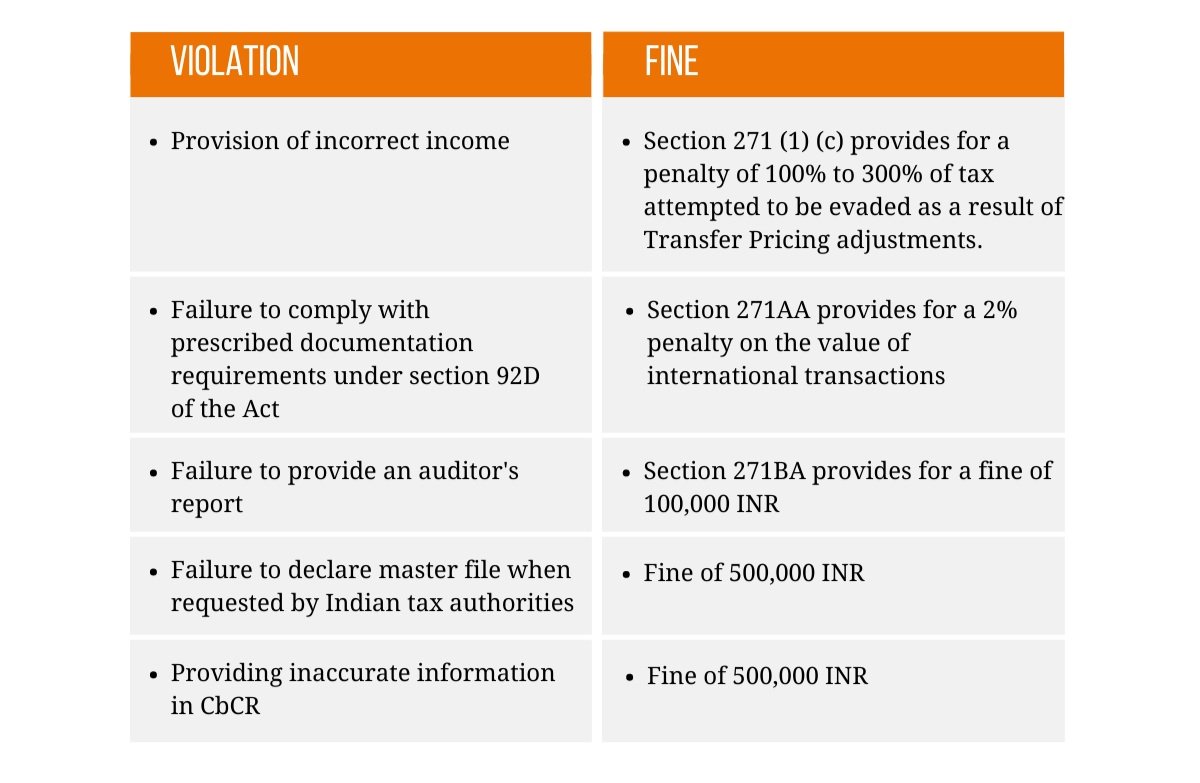

These penalties are linked to incorrect transfer pricing in India:

Advanced Pricing Agreements (APAs)

The dispute resolution process in India is slow and very time-consuming. Therefore, the government has introduced an alternative: the Advance Pricing Agreement (APA). APA is a procedural agreement between the taxpayer and the tax authority to avoid transfer pricing disputes by defining in advance a set of criteria to be applied to specific cross-border controlled transactions within a certain period of time and thus the ALP is determined in advance.

Unilateral APAs with the CBDT protect companies from ALP adjustments initiated by India. It also helps in creating tax certainty, reducing litigation costs and avoiding double taxation. However, the taxpayer has to file an Annual Compliance Report (ACR) annually.

APAs can also be concluded bilaterally, between two countries. In November 2017, India entered into its first bilateral Advance Pricing Agreements (APAs) covering the electronics and technology sectors with the Netherlands.

Checklist for Transfer Pricing in India

The Indian tax authorities crack down very hard on TP malpractices. Non-compliance with applicable TP regulations results in penalties and significant interference in business operations by the tax authorities. Irrespective of the size, companies should pay close attention to ensure that their international transactions comply with the guidelines for TP in India, are robust enough to be audited by tax authorities and are designed to mitigate unintended tax consequences. Therefore, keep the following checklist handy and be prepared at all times:

Are you familiar with the arm's-length principle? Make sure you are familiar with the TP regulations in India, so as not to be in the dark.

Know how the arm's-length principle is calculated in India and whether your intercompany pricing meets the applicable TP standards.

Is your TP documentation in order? Prepare thorough documentation. Prepare annual transfer pricing documentation where necessary.

Review your policies regularly.

Always be audit-ready. Usually, audits can go back 3 to 5 years, which makes it even more difficult to have all the right paperwork in place in the blink of an eye.

Special guide for CFOs with operations in India

The Indian tax system can be a real headache for European CFOs with activities in India. In order to provide you with more insight into the complex tax and financial system every CFO in India has to deal with, consultancy firm IndiaConnected has therefore compiled an insightful manual that addresses the most frequently asked tax questions.

We can, of course, support you at all times in such matters. From obtaining all necessary documents for your first export from Europe to taking care of the entire back-office of your Indian entity, so that you can always fully focus on your activities in India. Contact us here.

Praveen Singal

Financial advisor - IndiaConnected

This article was written in collaboration with IndiaConnected's financial advisor, Praveen Singal.

Singal has over 25 years of experience in establishing successful business strategies for European companies looking to start up in India, corporate financial analysis and compliance.

He is also a qualified Chartered Accountant with a specialization in Indian taxation.