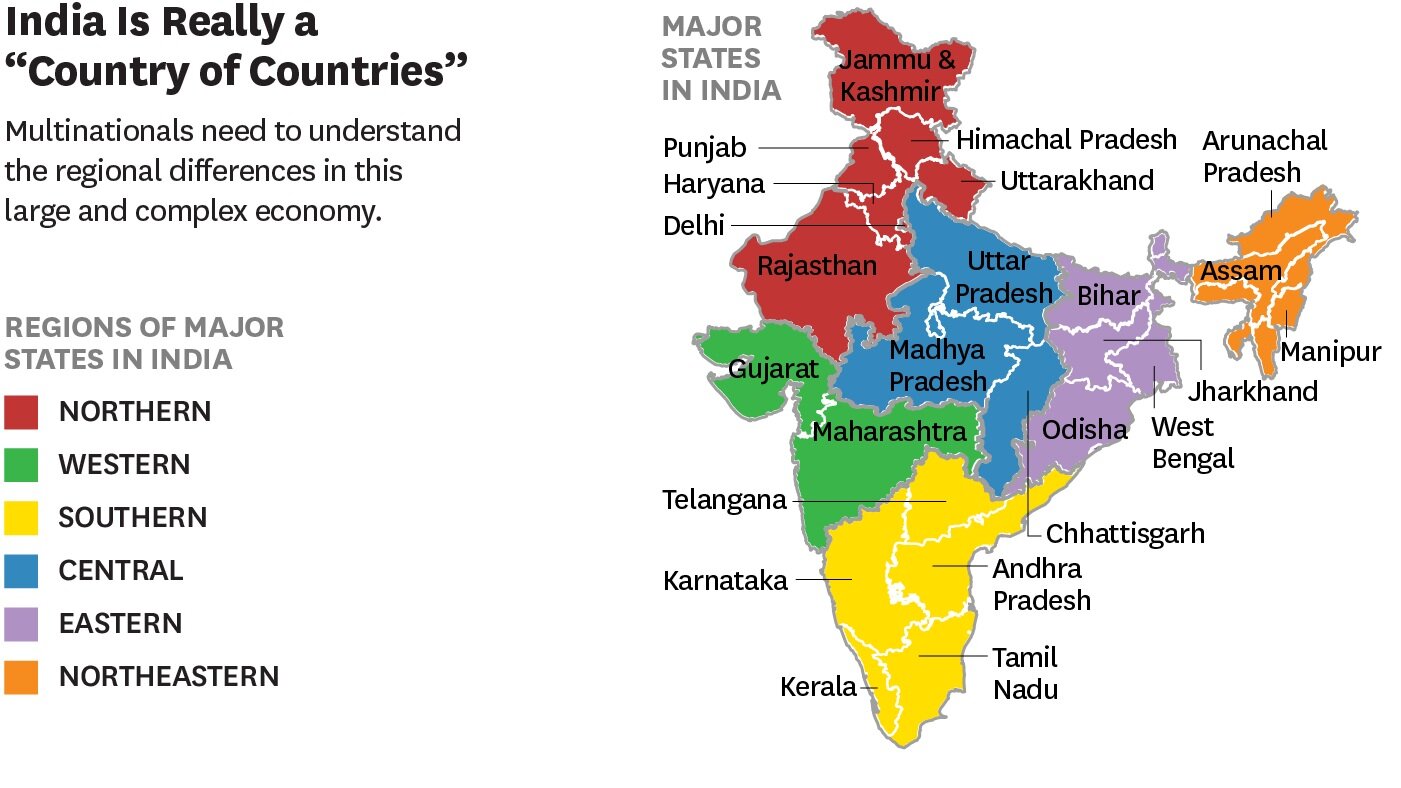

India is almost as large as the European Union and has more than twice as many inhabitants. No wonder, then, that there are major differences between the various Indian states in terms of language, demographics, politics and economic growth. For a successful start-up in India, it is therefore important to take these differences into account when drawing up a business plan. Because what works in Gujarat does not automatically work in West Bengal.

Image via Harvard Business Review

The regional differences among Indian states

For a European company to succeed in India, you must be aware of the country's vast regional differences. India is a fragmented market with large, and often underestimated, regional differences in language, culture, infrastructure and wealth, all of which affect the regional business culture.

Indian states are therefore better compared to individual countries than to, say, the Dutch provinces. Indeed, India's most populous state, Uttar Pradesh, has as many inhabitants as Brazil, and the southern state of Tamil Nadu has an economy as large as that of Hungary.

There are also large demographic differences between Indian states. For example, southern India is older, has more to spend and is more educated than the rest of the country. Northern India, on the other hand, is younger and relatively poor.

North Indians primarily speak Hindi, while South Indians prefer to communicate in English or in their regional state language, such as Kannada or Malayalam. The German wholesaler METRO, better known in the Netherlands as Makro, found out after their start in India that there are big differences between the groceries that customers in a certain region put in their shopping cart and adjusted the assortment accordingly by adding more local products. Logical really, Finns also have different preferences than Spaniards.

"METRO found out that there are big differences between the groceries that customers in different regions in India put in their shopping cart."

Do not make one business plan for all of India

For a successful start in India, thorough market research is a must. Regional differences are not only obstacles, but can also work in your favor depending on your sector and product.

The southwestern states, such as Maharashtra and Karnataka, are a suitable base for technical sectors such as automotive, engineering, as well as outsourcing IT and Research & Development teams.

Northern states such as Punjab and Haryana, among others, have thriving agricultural sectors, creating opportunities for food processing and renewable energy industries.

Starting in the right regions is also essential for selling your product in India. European products almost always fall in the highest market segment in India, so it is smart to start in the regions where people have sufficient income and there is real demand for a more exclusive, expensive product.

"Approaching India as one country by working with only one distributor or partner is one of the most common mistakes European companies make in India," says Klaus Maier, CEO of Maier + Vidorno, IndiaConnected's partner in India.

"In Europe, you wouldn't ask an Italian distributor to set up your network in Norway either. An Indian partner or distributor operating in a specific state has a good network only there and will not succeed in successfully expanding sales to other states. Therefore, those who take India seriously start with about four dedicated, local managers or distributors who understand your product and the regional market well. With them, the market can be mapped and the logistics network set up, one of the biggest challenges for international companies in India. In this way, the Indian market can be conquered step by step, successfully."

Selling successfully in India with the right strategy

For anyone looking to conquer the Indian market, IndiaConnected has put together a special guide in which we offer you insight into the steps to take to successfully start and grow your sales in India.

From preparing your first export shipment to India to setting up a solid after sales service, we guide and advise throughout your India journey.