The Indian tax system is often a headache for foreign CFOs with offices in the country. Nevertheless, the Indian tax system has undergone significant reforms in recent years and the paying taxes has become has become a lot clearer and easier. Here is what every foreign CFO should know about the Indian tax system.

Direct and indirect taxes

There are two types of taxes in India: direct taxes and indirect taxes. Direct taxes are levied on the income earned by companies or individuals in a financial year. The income tax paid by individual taxpayers is the Personal Income Tax (PIT). Individuals are taxed based on tax brackets at different rates. The income tax paid by domestic companies and foreign companies on their income in India is the Corporate Income Tax (CIT). The CIT has a specific rate as stipulated in the Indian Income Tax Act.

As the name suggests, indirect tax is not imposed directly on the taxpayer. Instead, this tax is levied on goods and services. Some examples of indirect taxes in India are the Central Excise and Customs Duty, and Value Added Tax (VAT). One of the most important indirect taxes is the Goods and Services Tax (GST), read all about it here.

Corporate Income Tax

In India, both domestic and foreign companies have to pay corporate income tax. According to the Indian Income Tax Act, you are a domestic company if you have a registered office or head office in India. A subsidiary company also falls under this category. You will be assessed as a foreign company if you have a branch office, project office or permanent establishment in India. While a domestic company is taxed on its universal income in India, a foreign company is taxed only on the income made in India. This sounds more advantageous, but it is not always the case.

Corporate Income Tax - Domestic Enterprises

The rate of Corporate Income Tax (CIT) applicable to a domestic company for the financial year 2020-21 is as follows:

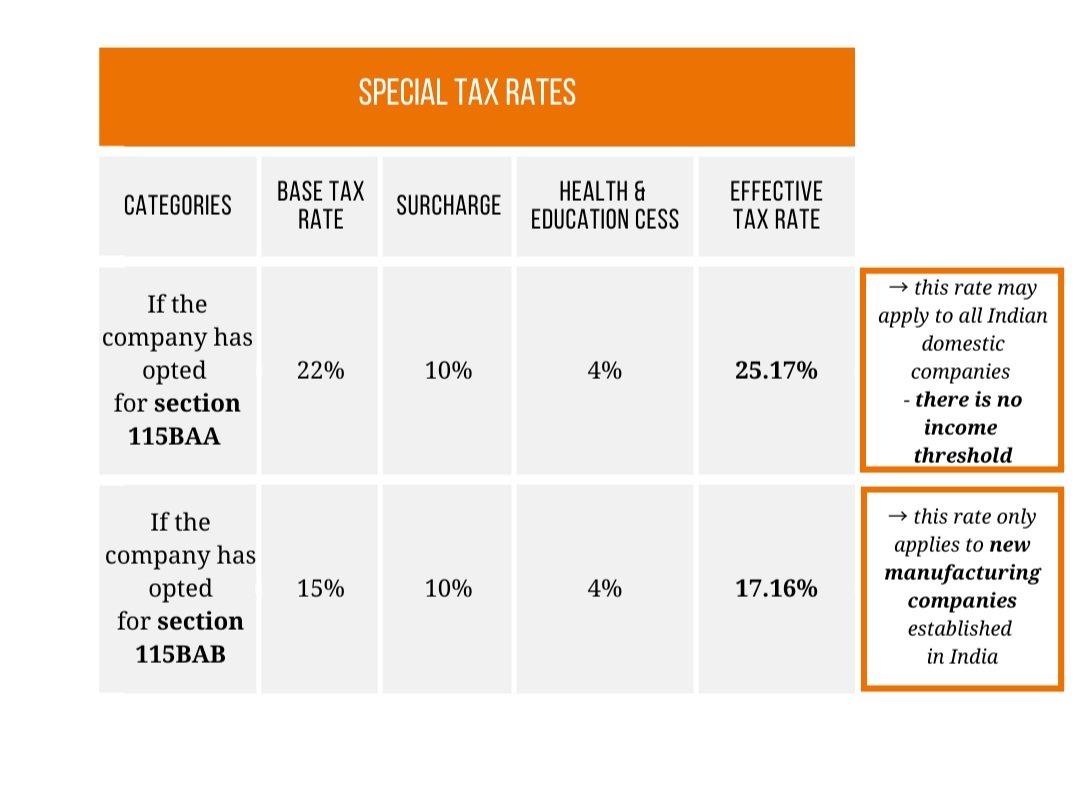

Articles 115BAA and 115BAB

In September 2019, the Government of India added a new section, 115BAA, to the existing Income Tax Act, 1961. This section offers domestic companies a reduced corporate tax rate from the 2019-2020 financial year (AY 2020-21) onwards, if these domestic companies meet certain conditions. The tax rate will then no longer be 25 or 30 per cent, but 22 per cent.

What are the terms of Articles 115BAA and 115BAB?

Firstly, domestic companies must not already be using other exemptions or incentives to qualify for deduction under 115BAA. Therefore, the total income of such companies must be calculated without:

Claiming any deduction specifically available to units located in special economic zones (Section 10AA).

Request for additional depreciation under Article 32

Allowance for investments in new plants and machinery in designated backward areas of the States of Andhra, Pradesh, Bihar, Telangana and West Bengal under Article 32 AD.

Deduction under Article 33AB for tea, coffee and rubber factories.

Claiming deductions under Section 33ABA for deposits made into land rehabilitation funds by companies engaged in the extraction or production of petroleum, natural gas or both in India.

Applying for Article 35 deductions for scientific research.

Claiming deductions for the capital expenditure of specific farms under Section 35 of the Agriculture Act.

Article 35CCC - Expenditure on agricultural information projects.

Article 35CCD - Expenditure on a skills development project.

Claims for deduction under Chapter VI-A (80IA, 80IAB, 80IAC, 80IB, etc.) are not allowed, but deduction under Section 80JJAA is exempted. Section 80JJAA allows an employer to claim part of the salary of new employees through tax.

Claiming set-off of any losses carried forward from previous years, if such losses were incurred in relation to the above deductions.

The conditions for 115BAB are:

The company was incorporated and registered after 1 October 2019.

Production starts before 1 April 2023

The company shall be engaged in the manufacture or production of any article or product, and/or research relating to such product. The company may also engage in the distribution of the article or product produced by them.

The company may not invoke this condition if it is formed by splitting or reconstructing a pre-existing company within the meaning of Article 33B.

The company cannot apply this condition if it is using a plant or machinery which has been used for any purpose previously. Used imported machinery is allowed if such machinery has never been installed in India and depreciation of such machinery has never been claimed in India.

Please note!

It is extremely important that companies are certain that they will be better off by opting for the lower tax rate of 115BAA before they actually take that step, because once a company takes advantage of the reduction, it must be continued in subsequent tax years. Since there is no time limit in which the option under section 115BAA can be exercised, it is better to take your time and find out how much benefit other exemptions and incentives can bring to the company. Subsequently, 115BAA can always be opted for, but note that once it is exercised, it must be continued.

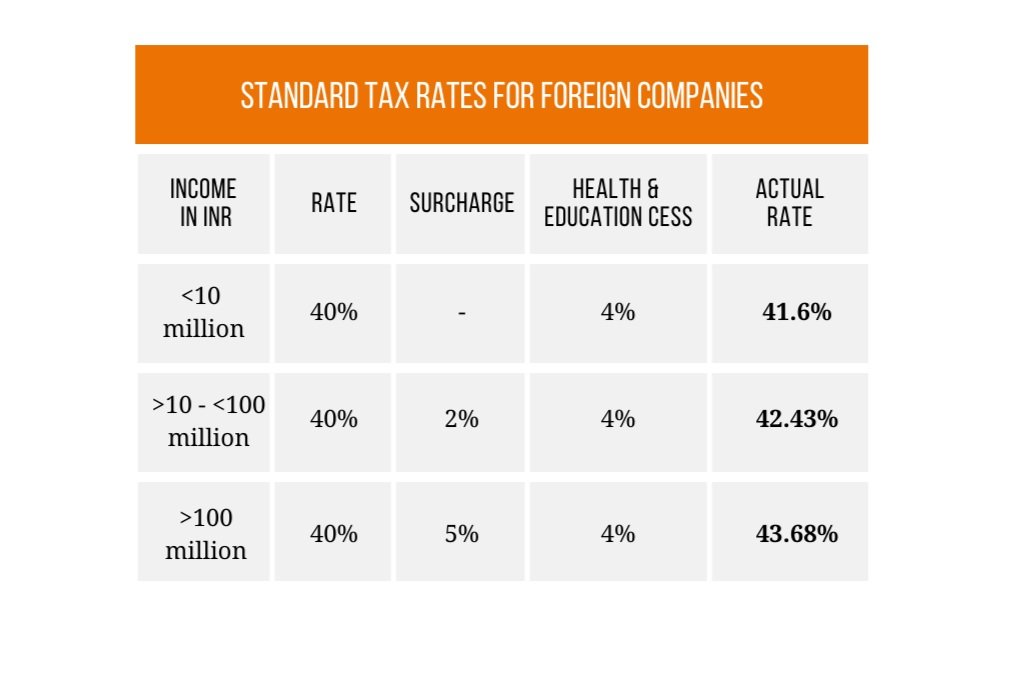

Corporate Income Tax - Foreign Corporations

As explained earlier, if you have a branch office, project office or permanent establishment in India, you will be taxed as a foreign company. While a domestic company is taxed on its universal income in India, a foreign company is taxed only on the income earned in India.

The rate of Corporate Income Tax (CIT) applicable to a foreign company for the financial year 2020-21 is as follows:

These tariffs are higher than the tariffs for domestic companies and you, as a foreign company, cannot claim tariff reductions like the 115BAA either. If you are just starting out in India and your turnover is still low, these high tariffs are manageable. But once you start growing, it is advisable to set up your own entity in India so that you can take advantage of the favourable tax rates for domestic companies.

Filing your income tax return

Normally, all companies, including foreign companies, must file their income tax returns on or before 30 October each year. Even if the company is incorporated in the same financial year, income tax returns must be filed for the period before 30 October. In addition, companies that have a turnover, profit or gross receipts of more than INR 10 million or about EUR 110,000 are required to have an audit carried out. This audit report must be submitted to the Indian Tax Department along with the income tax return. The audit report should be submitted annually by September 30, if the rule is applicable to your company.

A guide for CFOs in India

Doing business in India can be challenging, especially because the government processes require a lot of time and energy. That is why consultancy firm IndiaConnected wants to offer you insight into the fiscal and financial system every CFO in India has to deal with. From obtaining all necessary documents for your first export from the Netherlands to taking care of the entire back-office of your Indian entity, so you can always fully focus on your activities in India.