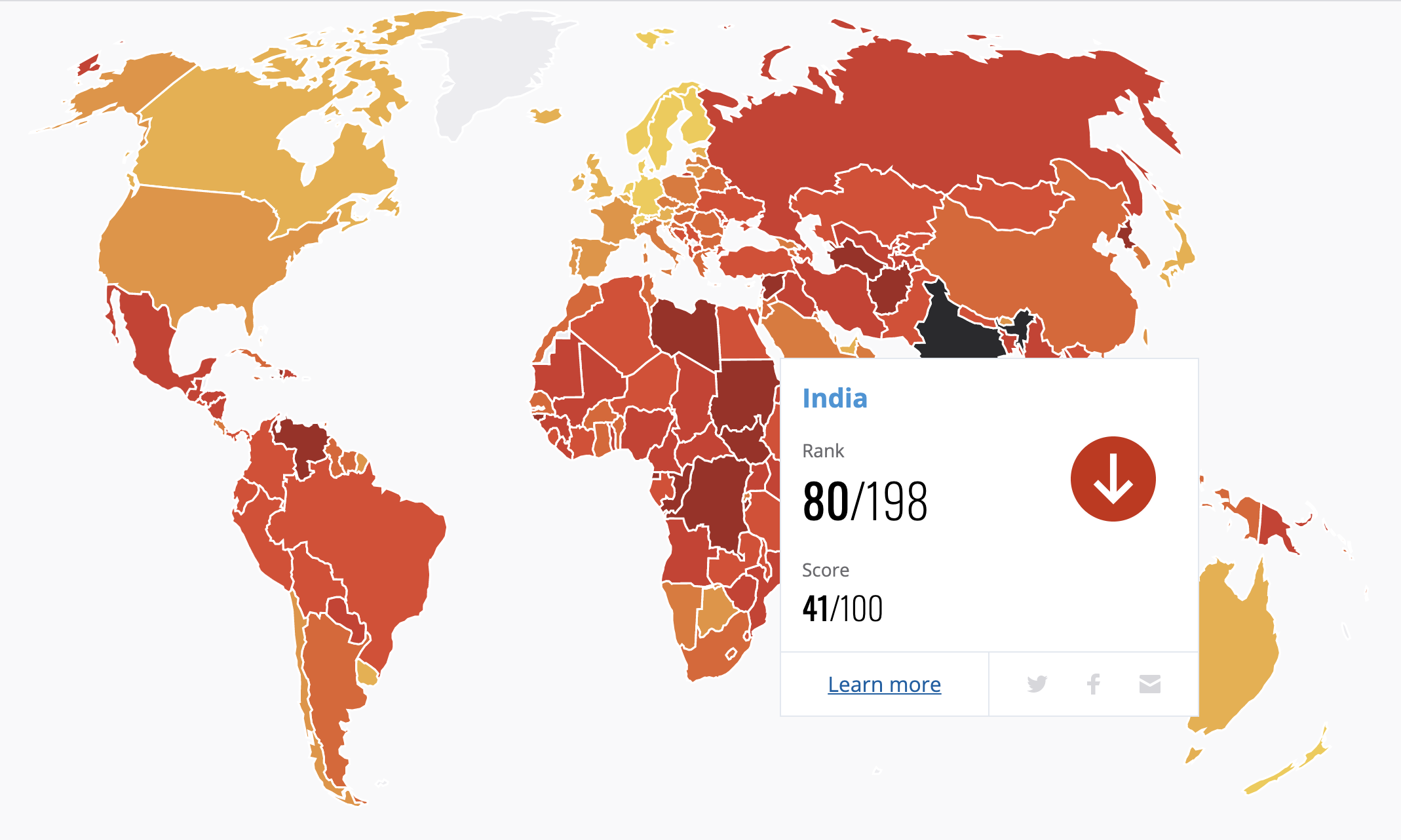

Any foreign company doing business in India will eventually have to deal with corruption. Prime Minister Modi has made many changes in recent years to improve the situation in the country, but India still ranks 80th in Transparency International's corruption index. As an international company, you want to stay as far away as possible from paying bribes, because this can have serious consequences not only in India, but also in your own country.

Every year, Transparency International ranks 176 countries worldwide on corruption. India is ranked 80.

Clean business takes time

It is still not uncommon in India to be asked for 'speed money', an amount paid under the table to get a permit approved more quickly, for example. Despite the fact that in some cases it seems as if there is no other solution than to pay, we strongly advise international companies against this. Firstly, it is of course forbidden and secondly, it is perfectly possible to do clean business in India.

For instance, the German IT company Optanium went to India to look for an accounting firm that could set up their entity in India without paying bribes. The process of setting up the company took longer, thirteen months instead of six, but it allowed Optanium India to get off to a flying start. An important tip is therefore to plan enough time for dealing with issues such as applying for licences or the release of your products from customs.

It is easier for foreign companies not to cooperate with corruption'.

In an interview with Quartz, Ravi Venkatesan, former chairman of Microsoft India and author of the book 'Conquering the Chaos: Win in India, Win Everywhere', explains how companies should deal with corrupt situations. "It is easier for a foreign company not to participate in corruption. The local management can stand firm and say that paying bribes is against their company policy. If a hard line is taken, the bribe-takers will drop out."

In addition, having a very strong administrative department is essential, according to Venkatesan. "Manage your business with competent, long-term administrative staff who can hold their own in discussions with officials. Many companies do not invest enough in these functions because they do not see them as the core of the business. Instead, they outsource these administrative tasks to local agents, who do pay the 'speed money' and simply bury it in their other expenses."

"Many companies in India do not invest enough in administrative staff. That makes them vulnerable to corruption."

Always your papers in order

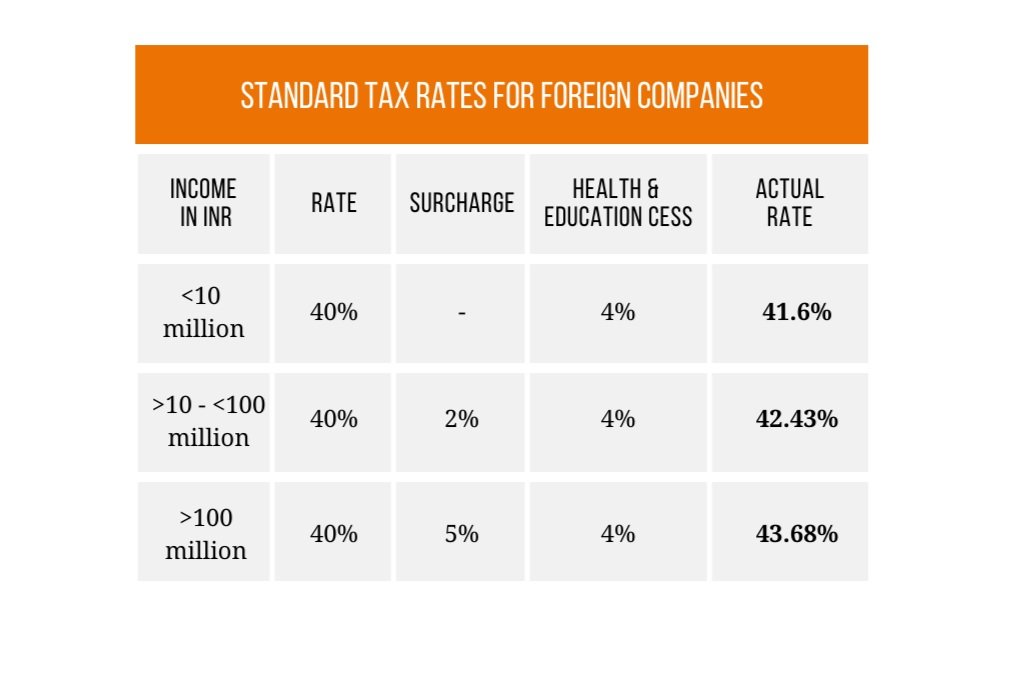

Fortunately, there are more and more situations in India where corruption has been completely eliminated because those processes are now automated or better controlled, such as filing your taxes or getting your identification. If you make sure you always have all your paperwork in order and therefore never need special assistance, you can avoid corruption with ease.

Of course, the experts at IndiaConnected can help you ensure that your business is always and in every area compliant.