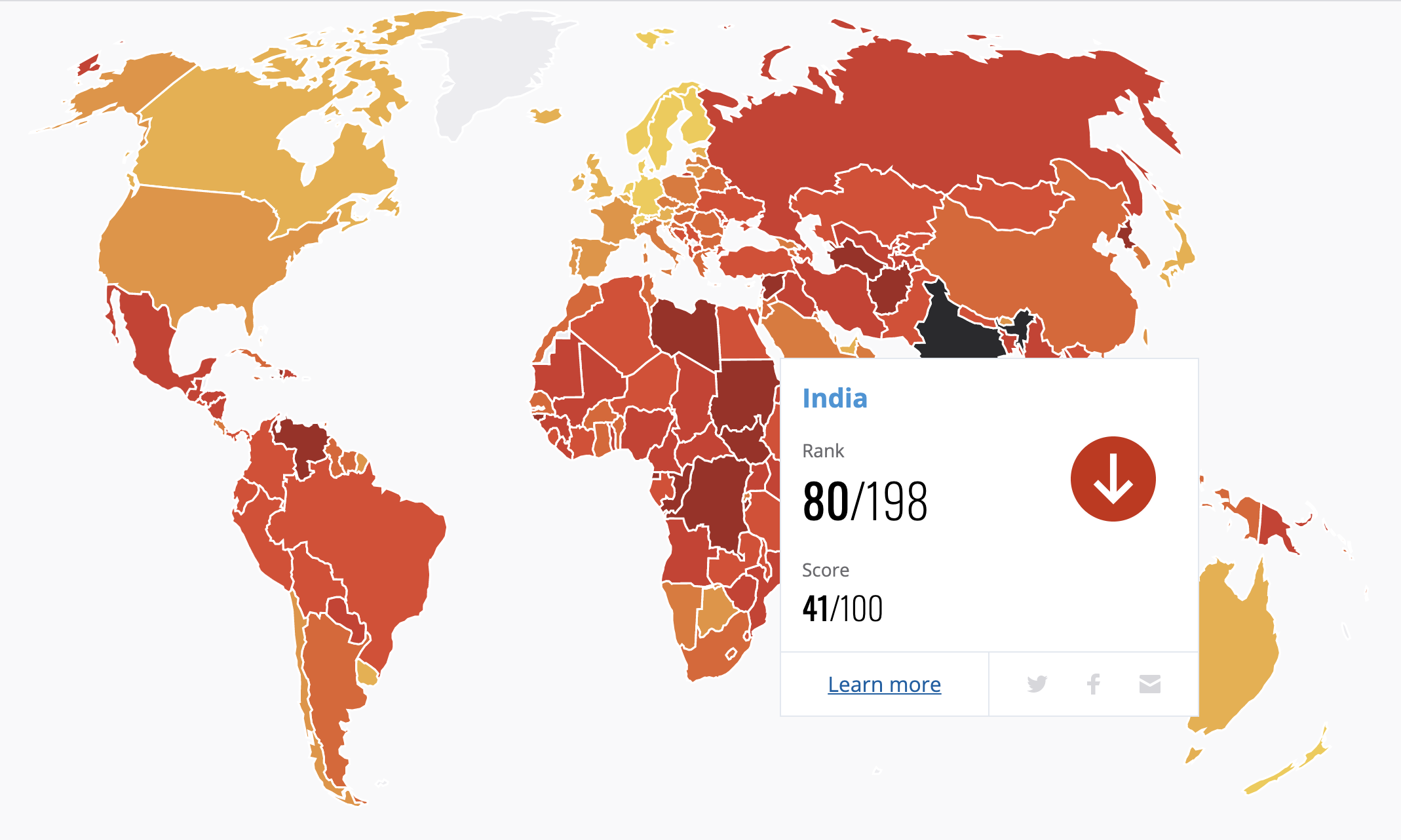

Since 2021, the Organization for Economic Co-operation and Development (OECD) has been tackling tax evasion globally by companies -who shift their profits to low-tax jurisdictions. This so-called BEPS (Base Erosion and Profit Shifting) project focuses specifically on tax challenges of the new, digital economy. India has incorporated the measures from BEPS into its tax code, which may affect your company if you do business in India.

The key concept that India has adopted from the BEPS project is "Significant Economic Presence" (SEP). We explain the implications of this addition for Indian tax law in this article.

Significant Economic Presence (SEP).

Significant Economic Presence means that tax should be levied if a company has significant involvement in the market where it will pay the tax, even if it has no physical presence in the country. Under current law, a foreign company in India constitutes an SEP if:

it enters into a transaction involving goods, services or property with a legal entity in India, including downloading data or software, and the total payments resulting from such transaction(s) exceed 20 million rupees (220,000 euros) in the previous year.

or

it engages in continuous business recruitment or is in contact with at least 300,000 users.

The implications of SEP for foreign companies in India

The idea behind the SEP provision is to ensure that no one who makes profits in a country avoids taxation there and that all players are valued the same way. Despite the OECD's regulatory focus on the digital economy, the current implementation of SEP in India has a broad scope. Indeed, it covers all transactions involving goods, services or property conducted by foreign companies with a legal entity in India, whether online or offline.

The SEP has been implemented in a very broad sense in India, with the result that even foreign companies that have no entity in India are already considered SEP by their activities. For example, the one-time export of goods to India by a foreign company, which is not otherwise active in India, can already trigger the SEP provision if it exceeds 20 million rupees (€220,000).

Thus, Indian law looks at both the regularity with which you as a foreign company operate in India and the income involved. Once the provision takes effect, the foreign company must keep accounts, undergo audits, pay taxes and file tax returns in India.

SEP and the European tax treaties with India

Companies with operations in India that are located in countries with which India has a tax treaty will obviously not be double valued because they are classified as SEP. Indian laws also dictate that for foreign companies, the most favorable provisions of either the Indian tax code or the tax treaty will govern.

India's tax treaties with Europe do not use the term SEP but the term Permanent Establishment, which has a narrower scope. As long as foreign companies can prove that they do not have a "permanent establishment" in India, they remain outside the scope of the SEP provisions. For this, however, the company must be able to provide documentation, including a certificate of tax residency, a statement that they do not have a 'permanent establishment' and Form 10F.

However, the SEP provisions will always apply to companies coming from countries that do not have a tax treaty with India (all European Union member states have a tax treaty with India). For companies from these countries, it is important to constantly check whether the transactions trigger the SEP provisions.

Everything you need to know about the tax side of doing business in India

SEP and Permanent Establishment are not the only insidious, tax issues European companies encounter in India. IndiaConnected has been active in India for ten years and annually helps hundreds of companies with their questions about the Indian tax system and other tax issues. To help companies get started, we have therefore compiled all our knowledge and tips into a free guide for CFOs with operations in India.