India is becoming a very popular manufacturing location for European companies because of its large talent pool of highly skilled workers, low costs, excellent knowledge of the latest technology and strategic location. This makes India not only a great manufacturing hub, but also the perfect home base from where the region can be easily supplied. More and more European companies are therefore choosing India as a manufacturing location to export their products to neighboring countries.

If you use India as a regional manufacturing hub, you naturally want to be able to export your products directly from the factory, rather than having to send them to your European headquarters first. This direct way of exporting is called merchant trading. In this article, we explain how merchant trading from India works and how to get the right permits.

Merchant Trading as a European company

Merchant Trading means that a shipment of goods takes place from one foreign country to another foreign country through an "intermediary" or "merchant" in a third country and without entering or leaving the merchant's country. Merchant trading thus helps companies avoid paying double import duties.

Let's simplify this with an example. A Dutch company has a subsidiary in India that manufactures its products. The Dutch company has found a Singaporean customer who wants to buy the products manufactured in India. Instead of importing the products to the Netherlands and then exporting them to Singapore, the Dutch company asks the Indian subsidiary to deliver the products directly to the buyer in Singapore. This means the products never enter or leave the Netherlands.

In this case, we speak of merchant trading because:

- the supplier of the goods to be exported is the subsidiary in India;

- the buyer of the goods to be exported is the customer in Singapore;

- the merchant or intermediary is the parent company in the Netherlands.

But we speak of merchant trading not only when a subsidiary is involved, but also when a company purchases the products it will ship to the customer from a third party.

For example, the Dutch company receives an order from a customer in the US for a specific product that it does not produce itself from a customer in the US. The Dutch company places an order with a supplier in India who manufactures the product and asks the Indian supplier to ship the goods directly to the customer in the US. Again, the goods do not enter or leave the Netherlands, so again in this example the Dutch company is the merchant trader.

In this example, the Indian supplier sends its invoice to the Dutch company, which then sends its own invoice to the American customer. In the example where the goods are delivered by the Indian subsidiary, the international and local transfer pricing rules apply to the sale of the goods from the Indian subsidiary to the Dutch parent company.

Paying GST (VAT) on a Merchant Trade

According to the IGST Act delivery to a location outside India by an Indian supplier is treated as delivery of goods between two Indian states. In the CGST Act states that activities or transactions are not treated as a supply of goods if the goods are delivered from one place in a non-taxable territory to another place in a non-taxable territory without the goods entering India.

This means that in our examples, where the goods are supplied from India, the IGST Act applies and GST is payable. In the case where the trader is the Indian company, the CGST Act applies and no GST is due either.

Required documents for Merchant Trading from India.

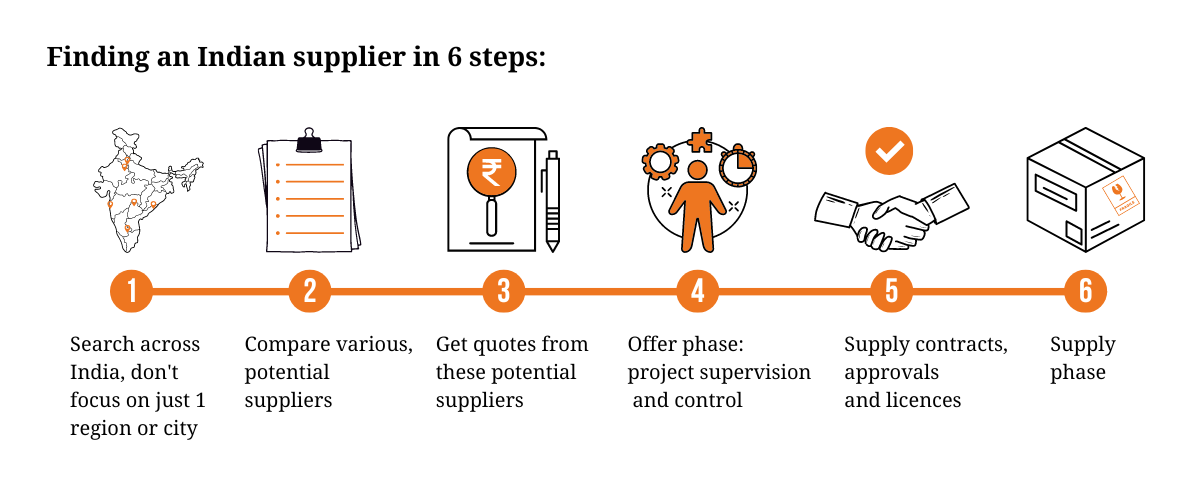

The documents needed to ship goods from the supplier to the customer depend on the specific products being sold and whether the Indian company is the supplier or the merchant in the deal. If the latter, at least 13 documents must be submitted to enable the Merchant Trade. It is therefore strongly recommended to work with a local expert in this field, who can advise you on how best to set up the merchant trade and support you in obtaining all the necessary documentation.

Our experts are available to answer all your questions on this topic and to help you successfully complete your first merchant trade.

Shashank Verma

Vice President of Supply Chain Management

This article was written in collaboration with vice president of Supply Chain Management, Shashank Verma.

Verma has over 22 years of experience in establishing business strategies, managing the supply chain of hundreds of European companies, establishing sound logistics in India and other related functions with a focus on revenue growth and profit maximization of organizations.